It's called Simple Interest and is how most interest is done which actually favors the consumer.That's my point, the equalization over the amortization of the loan period is a formula that greatly favors the lender over the borrower. Every month, the unpaid interest accrues to your mortgage balance. Say you took out a mortgage for $500,000 with an interest rate of 4.5% and a term of 30 years. You're not actually paying just 4.5% of $500,000 as interest; you're paying interest on what remains of the balance after each payment each month.

This means that 15 years into a 30 year mortgage, you haven't paid off 50% of the loan. You have only paid off 30% of it on a 4.5% APR interest rate. If you only stay in the mortgage for 15 years or less, you have paid mostly interest to the bank and far less on your home. You are only paying off the majority of your home in the back half of the loan term, with most of it in the very last few years.

Year 1, you are paying $1875 a month of interest to the bank and only $658 to yourself in the form of principal on your home.

Year 30, you are paying $111 interest and keeping $2422 in principal payment.

The loan is set up to pay down principal the slowest up front, maximizing interest to the bank and slowing the payoff of the home until the back end of the loan. This is an amortization schedule that greatly favors the bank over the borrower. To make this arrangement more favorable to the borrower, they would/should make larger principal payments as early in the loan as possible.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Retirement Planning/ Investment/ Savings Thread (3 Viewers)

- Thread starter inca911

- Start date

Counterpoint:

Counterpoint to your counterpoint

The house you live in is an investment in quality of life. I agree that it's not the most financially optimal way to use your money but renting from someone else is worse and that's your only other option. You need a place to live and that comes at a cost - especially in Texas where land is freely available.

But I bought a flat in London in 1997 which has appreciated approximately 400% since then. Real estate can be highly profitable if you're in the right market.

However I personally look at a mortgage as forced savings. I have been mortgage free a couple times in my life and I ended up spending the money that would usually go every month to the mortgage payment on toys. I don't have the discipline to put that money away in to investments etc as I'm always tempted to spend it on the next shiny thing that comes along. So for me, it's better to service debt than piss the money away on extra stuff. What works for me may not be optimal for the more disciplined but if I had discipline, I wouldn't be overweight, have a drinking problem and 14 sets of poker chips.

Not the best investment but it is an investment. The worst investment?!?! A car which is a depreciating asset opposed to real estate that does not depreciate like a car.It amazes me the number of people who believe a house is the best investment. I agree with you. 25 years of property taxes and maintenance will exceed any appreciation on our cost to build. Not an investment.

My home has been a great investment so far. I purchased it last year and already have had a 10% increase in value!

My house and living in it has been the best investment I have ever made, bar none. Every penny I've put into it has not only increased the value of it, or mitigated some of the future maintenance of it, or has markedly increased my family's enjoyment of living in it. When it comes to living your daily life, an investment should be counted on more than the money you've put in compared to the money you think you'll get out.

At almost 15k/yr in property taxes - my home would need to rise significantly to keep up.I guess it's more "location, location, location" then, because being in Colorado, our house prices are much higher than other parts of the country *cough*Texas*cough*

The average single family home in CO is roughly $500,000 (Denver is $600K+), and they keep going up....so growing up, I always thought buying was better than renting....and it has worked out pretty well for us....but again, looking at prices in other parts of the country I can see why that sentiment could be true.

No disagreement here. Even worse than a car, is a leased car.Not the best investment but it is an investment. The worst investment?!?! A car which is a depreciating asset opposed to real estate that does not depreciate like a car.

My home has been a great investment so far. I purchased it last year and already have had a 10% increase in value!

Forty4

Full House

A boat is worse than a car but probably better than a leased car. Although I could see situations where the boat is worth less than the note and so maybe a leased car is better.No disagreement here. Even worse than a car, is a leased car.

A boat! I didn't even think of that.A boat is worse than a car but probably better than a leased car. Although I could see situations where the boat is worth less than the note and so maybe a leased car is better.

Happiest day of a boat owners life? When they sell it.

Poker Zombie

Royal Flush

I wouldn't even consider a lease in the same realm as investments. It's a rental. You pay for gas, and return it when you are done.

I have leased many cars, but never think of it as anything more than spending money. The nice thing about the lease is ever few years you get the latest in automotive tech. But like a movie, a meal, or custom CPC chips, you aren't investing, you are paying for the experience and benefits.

I have leased many cars, but never think of it as anything more than spending money. The nice thing about the lease is ever few years you get the latest in automotive tech. But like a movie, a meal, or custom CPC chips, you aren't investing, you are paying for the experience and benefits.

What about my pontoon?A boat! I didn't even think of that.

Happiest day of a boat owners life? When they sell it.

Regarding leasing a car, it depends on how often you buy/sell your cars. Some good articles on the break down of both and when each makes the best financial choice.

What’s better than a boat? A friend with a boat!A boat! I didn't even think of that.

Happiest day of a boat owners life? When they sell it.

Forty4

Full House

What about my pontoon?

Apparently you’ll have more friends.What’s better than a boat? A friend with a boat!

You can buy it. I'll come use it and bring the beer.What about my pontoon?

We all have to make shitty investments (Pontoon) once in a while too. It does a man no good to die with a big bank account. But on the flip side I know we have to be mostly responsible!

My wife just said she disagrees with youIt does a man no good to die with a big bank account.

It’s not a bad investment if it brings you a greater value of utility!We all have to make shitty investments (Pontoon) once in a while too. It does a man no good to die with a big bank account. But on the flip side I know we have to be mostly responsible!

Sharing an item I recently learned. If you qualify for a Health Savings Account (HSA), typically by having a High Deductible Health Plan (HDCP), the money you put into the HSA is all pretax dollars, and both the initial principle as well as any appreciation are not taxed when used for qualified medical expenses (e.g., actual medical costs, COBRA insurance coverage, or Medicare premiums--not Medigap). This is pretty basic info, but what I found out is that when you turn age 65, the 20% penalty to access the money in the HSA for unqualified (i.e., non-healthcare) expenses goes away. Yes, you have to treat withdrawals used for nonqualified expenses as income for tax purposes; however, you can get access to your HSA money without penalties. This means the HSA growth of pretax dollars is fully in place, similar to a 401(k), so you get the added value of investing with more dollars. Any growth on an invested HSA portfolio is never taxed for qualified expenses, and is only taxed as income after age 65 if you choose to tap into your HSA fund for non-medical items (e.g., food, clothing, global cruise). Fully funding an HSA is now my #3 recommendation for younger folks, behind #1: maximize any offered corporate 401(k) match from your company, and #2: fund a Roth IRA where you can get access to your principle without penalty (i.e., provides a very liquid emergency fund, although you can't put the principle back in if you choose to take it out).

Last edited:

But I bought a flat in London in 1997 which has appreciated approximately 400% since then. Real estate can be highly profitable if you're in the right market.

Agreed 100%. I was careful to mention that the house you live in is a poor investment. I own two other rental properties, and had a 3rd at one point in Ottawa that was sold for a tidy profit along with the years of rents in my pocket. Real estate can be a great investment, there is no doubt.

Some in the thread have a different view of what an investment is, and I absolutely agree that not all investments require a return in dollars to be "good". If you're looking to turn dollars into more dollars however, my personal residence would be just about the last place I'd look to do that.

Marius L

4 of a Kind

Cars are not investments. They are money drains but obviously necessities for many people. Boats are even more waste of money, but a luxury item people are willing to pay a lot of money for. They will never appreciate in value though. And while I agree the house you live in might not be the best financial investment, keep in mind that it might be worth it for you to LIVE BETTER. And it also depends on where you live. In my city the housing market has been pretty crazy the last 10+ years, and owning a house in that time would definitely have been a very very +EV play.

Sharing an item I recently learned. If you qualify for a Health Savings Account (HSA), typically by having a High Deductible Health Plan (HDCP), the money you put into the HSA is all pretax dollars, and both the initial principle as well as any appreciation are not taxed when used for qualified medical expenses (e.g., actual medical costs, COBRA insurance coverage, or Medicare premiums--not Medigap). This is pretty basic info, but what I found out is that when you turn age 65, the 20% penalty to access the money in the HSA for unqualified (i.e., non-healthcare) expenses goes away. Yes, you have to treat withdrawals used for nonqualified expenses as income for tax purposes; however, you can get access to your HSA money without penalties. This means the HSA growth of pretax dollars is fully in place, similar to a 401(k), so you get the added value of investing with pretax dollars. Any growth on an invested HSA portfolio is never taxed for qualified expenses, and is only taxed as income after age 65 if you choose to tap into your HSA fund for non-medical items (e.g., food, clothing, global cruise). Fully funding an HSA is now my #3 recommendation for younger folks, behind #1: maximize any offered corporate 401(k) match from your company, and #2: fund a Roth IRA where you can get access to your principle without penalty (i.e., provides a very liquid emergency fund, although you can't put the principle back in once you take it out).

I like how some have called it the "stealth IRA"

Forty4

Full House

Boats somewhat appreciated this past year. COVID changed everything. Plus depending on the boats you buy the MSRP raises year over year thus your loss is somewhat diminished.

Completely agree with this! A tax unicorn as some say! My work offers a health contribution account, which disqualifies me form getting an external HSA. It makes me extremely mad. I've heard that you can also save any medical receipts and withdrawal without penalty later in life, before the age of 65. I worry that it's tax benefits are corrected before I'm ever able to take advantage. One of the instructors for my Chartered Financial Consultant designation shared similar feelings.Sharing an item I recently learned. If you qualify for a Health Savings Account (HSA), typically by having a High Deductible Health Plan (HDCP), the money you put into the HSA is all pretax dollars, and both the initial principle as well as any appreciation are not taxed when used for qualified medical expenses (e.g., actual medical costs, COBRA insurance coverage, or Medicare premiums--not Medigap). This is pretty basic info, but what I found out is that when you turn age 65, the 20% penalty to access the money in the HSA for unqualified (i.e., non-healthcare) expenses goes away. Yes, you have to treat withdrawals used for nonqualified expenses as income for tax purposes; however, you can get access to your HSA money without penalties. This means the HSA growth of pretax dollars is fully in place, similar to a 401(k), so you get the added value of investing with pretax dollars. Any growth on an invested HSA portfolio is never taxed for qualified expenses, and is only taxed as income after age 65 if you choose to tap into your HSA fund for non-medical items (e.g., food, clothing, global cruise). Fully funding an HSA is now my #3 recommendation for younger folks, behind #1: maximize any offered corporate 401(k) match from your company, and #2: fund a Roth IRA where you can get access to your principle without penalty (i.e., provides a very liquid emergency fund, although you can't put the principle back in once you take it out).

RainmanTrail

Straight Flush

Something worth keeping in mind regarding buying a house as an "investment" is the opportunity cost of NOT buying a house (i.e., renting).

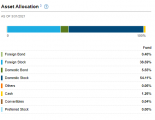

So I’ve always been a Target Fund guy. Based on my options here, what would you recommend? The S&P 500 Stock Index and Small/Mid Stock Index are ones that caught my eye. I also included current asset allocation of my 2045 fund. Hopefully you can read the screenshots.This. If you don’t feel comfortable about doing it yourself or think you may get lazy about it then one of the target funds works just fine. But it’s also something most people can spend a few hours a year to update/tweak and save yourself a literal boat load of money over your lifetime.

I’m still educating myself on this stuff, be gentle.

Poker Zombie

Royal Flush

Just remember, that you are paying a fee for the convenience of the Target Fund. I would look into the percentage that they take.

The way math works (numbers exaggerated because it is easier math), if they take a 25% fee and you earn 33%, did not earn 8% - you lost money.

100 x 1.33 = 133

133 - 25% = 99.75

Obviously, they aren't taking 25%, and a fund manager who didn't routinely earn his clients money would be replaced in short order, but do look to see what they are taking, and what you are actually earning.

I don't oppose paying for the convenience any more than I oppose paying someone else to change my oil. Just be aware, because some funds will blow smoke to make themselves look better.

The way math works (numbers exaggerated because it is easier math), if they take a 25% fee and you earn 33%, did not earn 8% - you lost money.

100 x 1.33 = 133

133 - 25% = 99.75

Obviously, they aren't taking 25%, and a fund manager who didn't routinely earn his clients money would be replaced in short order, but do look to see what they are taking, and what you are actually earning.

I don't oppose paying for the convenience any more than I oppose paying someone else to change my oil. Just be aware, because some funds will blow smoke to make themselves look better.

Frogzilla

4 of a Kind

While your broader point is certainly true (fees should be a factor in investment decisions)...I don’t think I’ve seen any funds (including the target date funds) advertise a pre-fee return %. Certainly the few I’ve held only showed me post-fee returnsJust remember, that you are paying a fee for the convenience of the Target Fund. I would look into the percentage that they take.

The way math works (numbers exaggerated because it is easier math), if they take a 25% fee and you earn 33%, did not earn 8% - you lost money.

100 x 1.33 = 133

133 - 25% = 99.75

Obviously, they aren't taking 25%, and a fund manager who didn't routinely earn his clients money would be replaced in short order, but do look to see what they are taking, and what you are actually earning.

I don't oppose paying for the convenience any more than I oppose paying someone else to change my oil. Just be aware, because some funds will blow smoke to make themselves look better.

If you stumble across someone advertising pre-fee returns, if that’s even legal, that’s probably a red flag

What are you already invested in?So I’ve always been a Target Fund guy. Based on my options here, what would you recommend? The S&P 500 Stock Index and Small/Mid Stock Index are ones that caught my eye. I also included current asset allocation of my 2045 fund. Hopefully you can read the screenshots.

I’m still educating myself on this stuff, be gentle.

View attachment 673917View attachment 673918

I like a mix. I'm an aggressive investor, so in in 98% stocks and 2% cash and bonds. My portfolio is managed and it's broken out like this.

I'm 60% in the last year and 8% YTD.

You need one more data point for each fund - what are the fees? Generally they are pretty low for passive funds but worth checking. Some actively managed funds charge up to 2% in fees which makes a massive dent on your returns. For get looking at the 1/5/10 year returns especially given the bull market we're currently in - look at the lifetime average.So I’ve always been a Target Fund guy. Based on my options here, what would you recommend? The S&P 500 Stock Index and Small/Mid Stock Index are ones that caught my eye. I also included current asset allocation of my 2045 fund. Hopefully you can read the screenshots.

I’m still educating myself on this stuff, be gentle.

View attachment 673917View attachment 673918

Personally in my 401k, I have 60% in a S&P500 tracker, 30% in International and 10% in US bonds. Currently I have stopped putting money in bonds as the prices are high/yields low so my paycheck contribution is 70% S&P/30% international. My target retirement is 20 years away although with some good fortune I'd like to be done in 10 years.

It's also important to look at this chart and understand the risks when it comes to retirement date:

If you looked at your 401k in mid 2000 and decided to retire in mid 2002, if you were 100% in the S&P500 your 401k would have dropped to half! It didn't recover until mid 2007 however had you continued working you would have been contributing over the dip and recovery leaving you in a much better position. Similarly if you looked at your 401k in mid 2007 and were a couple years out from retirement we had an even bigger drop to 2009 with recovery by 2013. Of course the opposite is also true.

For this reason, I think it's important to have some flexibility when it comes to retirement - if you can semi-retire and still earn some income then you're much more insulated from large market swings. And you can consider going more like 50:50 stocks:bonds to provide some insulation. And also diversify your assets outside of just the market. I have about half my assets in real estate in growth locations (excluding the house I live in).

ekricket

Royal Flush

If you have the option this is great advice. I retired not because of a magic age or number but because I was ready and the perfect storm came along of low interest rates (more pension) and phenomenal growth of savings and sucky stupid boss plus favorable tax penalty exemptions.For this reason, I think it's important to have some flexibility when it comes to retirement -

Similar threads

- Replies

- 2

- Views

- 252

- Replies

- 1

- Views

- 161