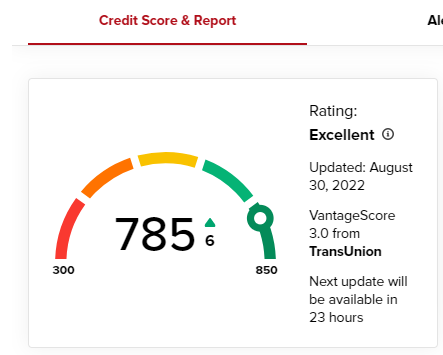

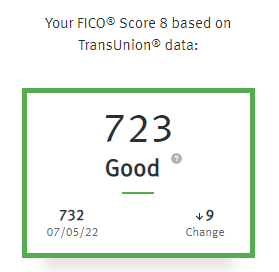

So the last time I got to see my actual score was in 2016 when I financed a vehicle for my girlfriend. At that time it came in at 867, somewhat a lot higher than the number I just checked a moment ago.

I’m not exactly sure how they ultimately determine your score but I guess it can fluctuate like anything else. I’ve always disliked owing anyone money and I’ve always liked the feeling of CASH in my wallet vs credit cards.

The only open credit I currently have is my home mortgage and 2 credit cards that I use for the rewards and pay off the balances every month. I also try to keep a minimum of 4 months worth of my regular monthly expenditures in my checking account.

I missed 4 months of work once from a freakish accident that happened to me back in my 20s. ( broke both my wrists at the same time, my left requiring surgery, a steel plate, 6 screws and a pin) Other than that, I’ve been fortunate enough since to not have any financial issues I couldn’t take care of arise. Fortunately I had an insurance policy kick in that paid my mortgage those 4 months I missed work.

I did a lot of crazy shit when I was younger, 35 bungee jumps, speedy bikes and speedy cars. My homeowners insurance guy talked me into an extra $12 a month in case I ever got hurt and couldn’t work. Made out on that one big time.

But it also wised my dumbass up about many of the “what ifs” in my financial life.

I’m not a financial expert nor do I want to spend my spare time trying to be. I pay a family trusted financial advisor 3/4 of a point to manage my personal investments. When I do borrow money from a bank, it’s always at as low of an interest rate as possible. If the bank doesn’t want to work with me, then I don’t need to do business with them. Simple as that!

Live within your means, it’s a lenders job to keep you in debt.