Dude, it's PCF I could prolly narrow down the net worth of people here based of their purchase habits. I've seen far far far weirder flexes on this site lmaoSuch a weird flex thread lol

-

PCF is an Amazon Associate and an eBay Partner. If you make a purchase through one of our links, we may earn a commission at no extra cost to you. Thank you for your support!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The credit score thread (1 Viewer)

- Thread starter Jonesey07

- Start date

850 isn’t the highest. We see transunion and equifax fico08 scores over 850 daily.Unless I mis heard the finance person that day but I swear that’s the number he told me. He then proclaimed it was the highest he had ever seen.

I believe you about the 850 being the highest, keeping track of my score has not been something I’ve ever done so I’m not completely understanding of the number system other than knowing anything over 800 is a really high score.

Ultimately where I want to be in the not so distant future. Only monthly bills being utilities and groceries.I'll flex.

I haven't looked at my FICO score in years, because I haven't needed to borrow money.

IDGAF what my score is.

Some rank 300-850 and some go to 900. Each group has a different system, I believe.Unless I mis heard the finance person that day but I swear that’s the number he told me. He then proclaimed it was the highest he had ever seen.

I believe you about the 850 being the highest, keeping track of my score has not been something I’ve ever done so I’m not completely understanding of the number system other than knowing anything over 800 is a really high score.

The freebie versions everyone gets at no charge are somewhat unreliable. I have seen customers tell me they are a 740+ then when I pull their FICO08 it’s 690.

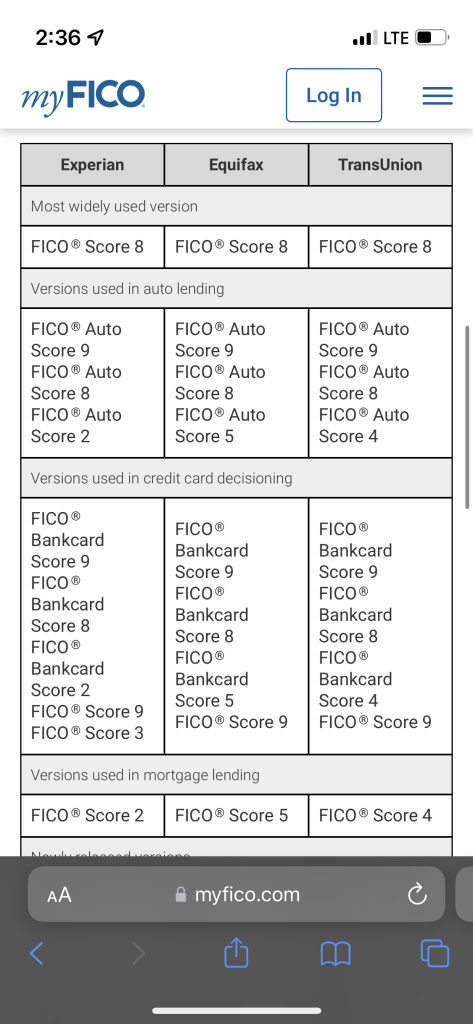

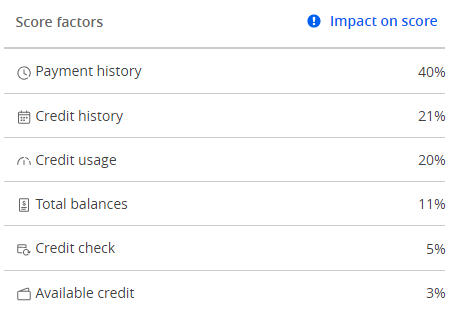

The auto industry, mortgage industry and credit card industry have scoring models that are weighted differently.

Any serious lender is going to use FICO08…

From the FICO website..

Base FICO® Scores range from 300 to 850. Industry-specific FICO Scores range from 250-900.

The auto industry, mortgage industry and credit card industry have scoring models that are weighted differently.

Any serious lender is going to use FICO08…

From the FICO website..

Base FICO® Scores range from 300 to 850. Industry-specific FICO Scores range from 250-900.

I had no idea that FICO has so many versions. I wonder how many mathematicians they lock in the back room to come up with these algorithms. Lord knows that give me that assignment and I'd be gone by lunchThe freebie versions everyone gets at no charge are somewhat unreliable. I have seen customers tell me they are a 740+ then when I pull their FICO08 it’s 690.

The auto industry, mortgage industry and credit card industry have scoring models that are weighted differently.

Any serious lender is going to use FICO08…

From the FICO website..

Base FICO® Scores range from 300 to 850. Industry-specific FICO Scores range from 250-900.

View attachment 982867

And they cost about $1.75-$3 a pull! Just depends what version you pull and what version the bank may take.I had no idea that FICO has so many versions. I wonder how many mathematicians they lock in the back room to come up with these algorithms. Lord knows that give me that assignment and I'd be gone by lunch

Most interesting thread! I see Credit Karma, TransUnion, and Equifax through USAA Bank. The scores sit between 820 and 835, seemingly at random, fluctuating +/- 2 to 6 points per month depending on what seems to me to be meaningless data.

I have six credit cards in use for specific cashback or travel purposes, with limits from $10K (the only one below $20K) to $38.2K. Each is paid off in full every month right before the payment due date; I haven't carried a balance in about forty years. None of those cards has ever broken the $7K due mark in any month that I can recall. All the credit reporting agencies seem to treat those monthly paid-off figures as "balances", with no hint that they're any different than actual balance carried forward.

I do not pay any attention to my oldest credit card account. I open and close accounts now and then for specific benefits. But it's easy to see that I've had a series of Cap One accounts and a series of Chase accounts for thirty years or so.

For example, right now TU and EFax are at 826 and 821. The only dings that have dropped those numbers a bit seem to be three hard inquiries in the past 18 months. One was for a new Capital One card which replaced a previous Cap One card, at a lower credit limit to boot. The other two are for the same event -- one from a VW dealer, and one from the VW bank (why two?), when I leased a VW GTI last year. Interestingly, the VW lease is at $165/month; the Alfa I turned in was leased at $550 per month. This would seem to me to be a credit improvement, not a ding.

As to the rest, we're not rich, but we're well off. We've never touched a penny of my wife's retirement and savings funds, and won't until she turns 70 in about 18 months. I keep $50K in USAA savings for potential emergency use. We live and travel on my retirement income of $10K/month, paid cash for our house worth $850K ten years ago, and have no other debt.

All that makes it hard to justify the emails I get from CK and others every month, telling me my scores have risen two or dropped four points (horrors!) and urging me to update our credit situation. It just seems like random bullshit.

I have six credit cards in use for specific cashback or travel purposes, with limits from $10K (the only one below $20K) to $38.2K. Each is paid off in full every month right before the payment due date; I haven't carried a balance in about forty years. None of those cards has ever broken the $7K due mark in any month that I can recall. All the credit reporting agencies seem to treat those monthly paid-off figures as "balances", with no hint that they're any different than actual balance carried forward.

I do not pay any attention to my oldest credit card account. I open and close accounts now and then for specific benefits. But it's easy to see that I've had a series of Cap One accounts and a series of Chase accounts for thirty years or so.

For example, right now TU and EFax are at 826 and 821. The only dings that have dropped those numbers a bit seem to be three hard inquiries in the past 18 months. One was for a new Capital One card which replaced a previous Cap One card, at a lower credit limit to boot. The other two are for the same event -- one from a VW dealer, and one from the VW bank (why two?), when I leased a VW GTI last year. Interestingly, the VW lease is at $165/month; the Alfa I turned in was leased at $550 per month. This would seem to me to be a credit improvement, not a ding.

As to the rest, we're not rich, but we're well off. We've never touched a penny of my wife's retirement and savings funds, and won't until she turns 70 in about 18 months. I keep $50K in USAA savings for potential emergency use. We live and travel on my retirement income of $10K/month, paid cash for our house worth $850K ten years ago, and have no other debt.

All that makes it hard to justify the emails I get from CK and others every month, telling me my scores have risen two or dropped four points (horrors!) and urging me to update our credit situation. It just seems like random bullshit.

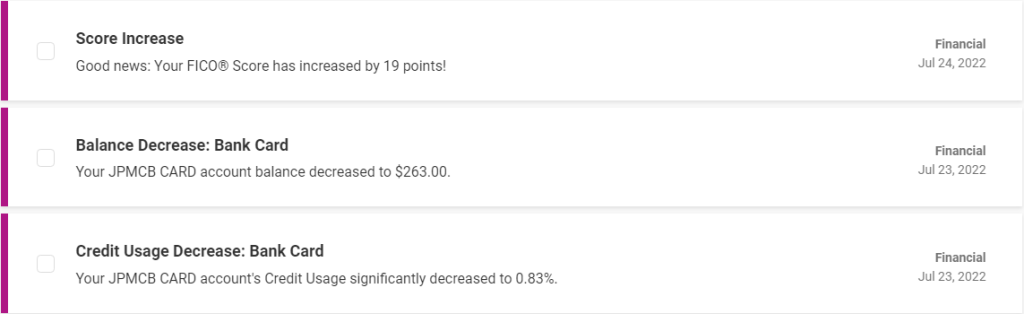

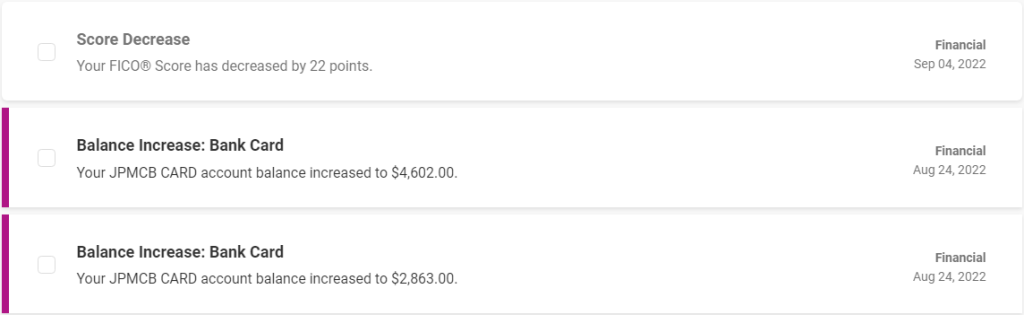

We left for vacation on June 16th and we don't use our US credit cards when we're travelling. A month later:

We return from vacation mid August and my wife starts spending again:

We return from vacation mid August and my wife starts spending again:

Some more info:

My sister works for Experian and she says that I have what they call a "thin file". I only have 2 credit cards and a mortgage; apparently the minimum is to have 5 accounts. I also have too low available credit on my cards - apparently I need to have access to more available credit. And my credit history is a little under 15 years - they state "The date that you opened your oldest account is too recent."

I don't really care about this and only opened a free Experian account as my sister works for them. I never knew what my score was before that.

My sister works for Experian and she says that I have what they call a "thin file". I only have 2 credit cards and a mortgage; apparently the minimum is to have 5 accounts. I also have too low available credit on my cards - apparently I need to have access to more available credit. And my credit history is a little under 15 years - they state "The date that you opened your oldest account is too recent."

I don't really care about this and only opened a free Experian account as my sister works for them. I never knew what my score was before that.

buzzmonkey

Flush

He was a libertarian economist. (Communists don’t need to borrow money, the State takes care of them from the cradle to the grave, ’member?)YEAH TELL YOUR PA IOSEPH STALIN I SAID HI, K BYYYYYE

Anyway, to each his own, some people like paying a big chunk of their lifetime income to lenders, some don’t.

Story: One of my best friends is an art dealer (maybe the only one in the world who is also a combat veteran).

Anyway, he does a lot of big auction deals and the art world equivalent of group buys, and often needs large amounts short-term credit to make this happen.

But he always pays off all loans quickly and on-time, to avoid the interest.

Over the years, he developed a huge line of credit with Bank of America from doing so many transactions with them.

Then one day, they cancelled it. No warning, out of the blue. No more credit for him.

He called to ask why... And was told it was because he always paid on time.

...

...

...

Because he always paid on time.

That tells you all you need to know about this racket.

Anyway, he does a lot of big auction deals and the art world equivalent of group buys, and often needs large amounts short-term credit to make this happen.

But he always pays off all loans quickly and on-time, to avoid the interest.

Over the years, he developed a huge line of credit with Bank of America from doing so many transactions with them.

Then one day, they cancelled it. No warning, out of the blue. No more credit for him.

He called to ask why... And was told it was because he always paid on time.

...

...

...

Because he always paid on time.

That tells you all you need to know about this racket.

I love you.

buzzmonkey

Flush

I know.I love you.

Here's my little contribution to this thread. I don't have near as much credit history as most on here, but I think I'm doing incredibly well for someone my age (22). I've been using Credit Karma to track my score. Probably check it once every month or so. Learned from a young age that if I'm going to buy something then I need to have the money for it or know where to get that money (let's say if it were going to come from a paycheck, selling something, bonus, investment or something along those lines). I'm working on building my credit history, but I got this from Credit Karma a month or so ago and I was very happy. I had such a big smile on my face. Currently sitting somewhere near the 760-775 area if I remember correctly. I'm gonna strive to get over that 800 level and beyond that.

Last edited:

Old State

Full House

- Joined

- Jul 20, 2016

- Messages

- 4,780

- Reaction score

- 7,273

Kinda of a flex thread but not really in that there are very high income people with bad credit because they don’t live within their means.

i understand some people get in trouble from circumstances they can’t control…but I’d wager the overwhelming majority of bad credit is self inflicted

i understand some people get in trouble from circumstances they can’t control…but I’d wager the overwhelming majority of bad credit is self inflicted

I wouldn’t say overwhelming. Divorce and medical bills I would put right up there as a reason why people have impaired credit. That’s why I said this entire thread is a wierd flex.Kinda of a flex thread but not really in that there are very high income people with bad credit because they don’t live within their means.

i understand some people get in trouble from circumstances they can’t control…but I’d wager the overwhelming majority of bad credit is self inflicted

Divorces get ugly. Why pay off the credit card for the spouse if your going through a divorce? What about car payments? Pay the mortgage and your not even living there? It gets ugly and USA divorce rates are 50%. And I won’t even get into medical bills…and some silly collections that kill a score 100 points, or a maxed out credit card that has a $1,000 limit.

Maybe you can call it self inflicted bc most generations were not educated at all on credit scores and I’m not sure how much they are at fault. And it really hurts the communities with low income/low education.

The banks have zero interest in good accurate credit scores. They want 400-600 credit scores for higher profit margins.

No doubt…there are professional assholes at getting credit and screwing banks, no doubt. But overwhelmingly in my experience a lot of bad things happen to good people.

ekricket

Royal Flush

https://www.investopedia.com/terms/d/deadbeat.asp

Apparently being a deadbeat is a good thing. Zero History

Apparently being a deadbeat is a good thing. Zero History

12thMan

Full House

I admit I'm jealous and pretty sad that I've never taken my credit very seriously, Now in my early 40s I’m playing catch up.

It’s not that it’s horrible, but in my early 20s I got into what I thought was an insurmountable amount of debt, like six grand , and let everything go to shit. (Hey 6 grand is a lot when all I cared about was gas to the mountain and a season pass lol) Everything was paid off but I never really got much credit after that until four or five years ago, I paid cash for everything and thought having a "huge" nest egg was better for me.

, and let everything go to shit. (Hey 6 grand is a lot when all I cared about was gas to the mountain and a season pass lol) Everything was paid off but I never really got much credit after that until four or five years ago, I paid cash for everything and thought having a "huge" nest egg was better for me.

I’m working on it the only way I know how: I open two or three credit cards with small limits (the highest one is 5k ) and charge things and then pay it off. My wife and I have a mortgage, but I’m not sure if that’s good or bad for credit.

) and charge things and then pay it off. My wife and I have a mortgage, but I’m not sure if that’s good or bad for credit.

I feel really stupid even typing this stuff compared to you guys that have such incredible credit scores and have been doing the right thing forever.

Does anybody have any tips on where to do research or what to do to improve a credit score?

Like I say, it’s not horrible, but without being married to my wife who has credit scores that could compete with you guys I would be paying through the nose for anything like a car loan or something. I need to grow up sometime, and over the last year or two I’ve been forced to face some very real mental health issues. Taking more control of my finances is part of that.

Would appreciate any tips and don’t flame me too hard.

It’s not that it’s horrible, but in my early 20s I got into what I thought was an insurmountable amount of debt, like six grand

I’m working on it the only way I know how: I open two or three credit cards with small limits (the highest one is 5k

I feel really stupid even typing this stuff compared to you guys that have such incredible credit scores and have been doing the right thing forever.

Does anybody have any tips on where to do research or what to do to improve a credit score?

Like I say, it’s not horrible, but without being married to my wife who has credit scores that could compete with you guys I would be paying through the nose for anything like a car loan or something. I need to grow up sometime, and over the last year or two I’ve been forced to face some very real mental health issues. Taking more control of my finances is part of that.

Would appreciate any tips and don’t flame me too hard.

ekricket

Royal Flush

Keep at it! That’s the best tip, you are aware of the problem and are working in it. So just keep it up, keep it up front, and after a few years you’ll be fine.I admit I'm jealous and pretty sad that I've never taken my credit very seriously, Now in my early 40s I’m playing catch up.

It’s not that it’s horrible, but in my early 20s I got into what I thought was an insurmountable amount of debt, like six grand, and let everything go to shit. (6 grand is a lot when a I cared about was gas to the mountain and a seasons pass lol) Everything was paid off but I never really got much credit after that until four or five years ago, I paid cash for everything and thought having a "huge" nest egg was better for me.

I’m working on it the only way I know how: I open two or three credit cards with small limits (the highest one is 5k) and charge things and then pay it off. My wife and I have a mortgage, but I’m not sure if that’s good or bad for credit.

I feel really stupid even typing this stuff compared to you guys that have such incredible credit scores and have been doing the right thing forever.

Does anybody have any tips on where to do research or what to do to improve a credit score?

Like I say, it’s not horrible, but without being married to my wife who has credit scores that could compete with you guys I would be paying through the nose for anything like a car loan or something. I need to grow up sometime, and over the last year or two I’ve been forced to face some very real mental health issues. Taking more control of my finances is part of that.

Would appreciate any tips and don’t flame me too hard.

A few years of wait is not much when you put it into a lifetime perspective. You may not be able to economically finance a new electric vehicle tomorrow, but by the time they are widely available you will!

It’s like anything in life, do the right thing and keep doing it and before you know it you wake up 5 years later in a much better circumstance.

I had a friend that went bankrupt and it literally only took her 5-7 years to have an awesome credit score again. To put that in perspective bankruptcy is worst case scenario for lenders as all your debt is wiped clean. Don't feel bad about it as many many people's finances are in shambles with tons of debt.Would appreciate any tips and don’t flame me too hard.

Make sure you have a handful of bills, mortgage, credit cards and pay them off regularly. Even a cell phone bill, the point is you just want to have bills/debt that they can see you are faithfully paying off. If you do this consistently you will have an amazing credit score. If you can't pay off your entire cc bill then make sure you pay your minimum payment on time. Given the interest rate charged by cc companies it is kinda crazy to borrow anywhere in the 20% range but that's a separate topic.

It is also worthwhile to check your credit rating and make sure there are no outstanding debts that are messing up your credit rating. Like sometimes stuff gets reported incorrectly and it never goes away. You can make a manual request to have things sorted out.

Constantly getting and cancelling credit cards can also have a negative impact. Having a couple credit cards and using the same ones over a few years probably will work best.

The mortgage is helping exponentially.I admit I'm jealous and pretty sad that I've never taken my credit very seriously, Now in my early 40s I’m playing catch up.

It’s not that it’s horrible, but in my early 20s I got into what I thought was an insurmountable amount of debt, like six grand, and let everything go to shit. (Hey 6 grand is a lot when all I cared about was gas to the mountain and a season pass lol) Everything was paid off but I never really got much credit after that until four or five years ago, I paid cash for everything and thought having a "huge" nest egg was better for me.

I’m working on it the only way I know how: I open two or three credit cards with small limits (the highest one is 5k) and charge things and then pay it off. My wife and I have a mortgage, but I’m not sure if that’s good or bad for credit.

I feel really stupid even typing this stuff compared to you guys that have such incredible credit scores and have been doing the right thing forever.

Does anybody have any tips on where to do research or what to do to improve a credit score?

Like I say, it’s not horrible, but without being married to my wife who has credit scores that could compete with you guys I would be paying through the nose for anything like a car loan or something. I need to grow up sometime, and over the last year or two I’ve been forced to face some very real mental health issues. Taking more control of my finances is part of that.

Would appreciate any tips and don’t flame me too hard.

A few credit cards is doing it right. Department store CC’s are the easiest to get approved. Just never have more than a 30% balance. Example, $1,000 limit, never have $300 or more charged on it. The credit bureaus will take random snapshots of the month with your balance. You want that balance less than 30% of your limit.

Auto loans are also a great way too. If you put a considerable amount of money down, regardless of score, the rate should be reasonable.

Example buy a 2020 Honda Pilot for $30K, put down $15k, finance $15k, even with a 550-650 credit score, I bet the interest rate would be around 10%.

Make 9-12 payments, then refinance or pay it off.

But if you do go with an auto loan, just try to put down 30-40% and it will significantly lower the rate.

Last edited:

louBdub

4 of a Kind

I'll flex.

I haven't looked at my FICO score in years, because I haven't needed to borrow money.

IDGAF what my score is.

Dude, what the fuck are you talking about? You don’t need to borrow money!?!?

Have you seen chip prices lately? I’m taking out a $20K loan to grab a couple barrels of these new chips, just to complete a set I put on my AMEX last week.

[laughs in unemployed]

Last edited:

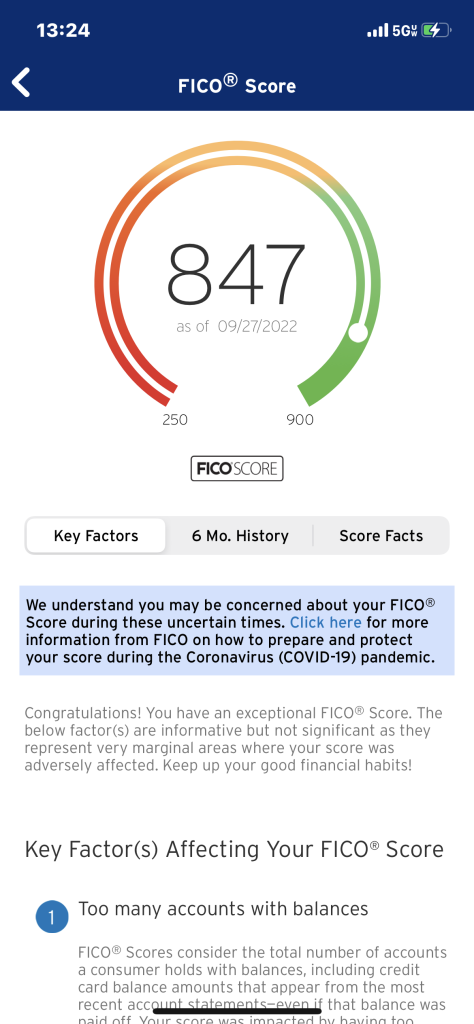

I don’t know how this happened. I guess that I like borrowing money and paying it back on time.

Dude, it's PCF I could prolly narrow down the net worth of people here based of their purchase habits. I've seen far far far weirder flexes on this site lmao

Sonofabitch! I gotta beat you fuckoo!I don’t know how this happened. I guess that I like borrowing money and paying it back on time.

View attachment 1010232

The Claw gets a lot of credit here too.Sonofabitch! I gotta beat you fuckoo!

The funny thing is, before we got married, my score was 805. Right after we got married, our combined score dropped to low 600s. That's what $25k in credit cards and $40k in student loans will do to a recent college grad's credit score.

The claw!The Claw gets a lot of credit here too.

The funny thing is, before we got married, my score was 805. Right after we got married, our combined score dropped to low 600s. That's what $25k in credit cards and $40k in student loans will do to a recent college grad's credit score.

The claw!

Similar threads

- Replies

- 3

- Views

- 575

- Replies

- 2

- Views

- 176

- Replies

- 3

- Views

- 609

- Replies

- 198

- Views

- 10K