Yoyahoo

Sitting Out

- PAYMENTS ACCEPTED

- PayPal Friends & Family

- Other (see below)

- SHIPPING TERMS

- Buyer Pays - Worldwide

- SHIPS VIA

- Other (see below)

Hi,

Paulson Private Cardroom set in very good condition.

Perfect for tournaments (up to 16 players) or cash games.

Chip breakdown:

Extras: Paulson rack + birdcage case included.

Price: $2,500 USD (shipping not included). Ships from France.

Buyer pays any US customs/taxes.

Prefer to sell full set, but open to selling items individually if needed.

i can send new photo

SHIPPING TERMS:

Buyer pays shipping and any applicable customs/duties. Shipping quote provided upon request.

SHIPS VIA:

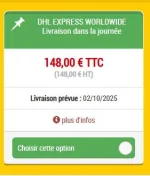

Colissimo International (France Post) or UPS / FedEx / DHL express, depending on buyer preference.

Classified Listing Rules:

This is a legitimate sale of a personal collectible. Buyer is responsible for all customs/duties/taxes. Payment must be received before shipping. Serious inquiries only.

Paulson Private Cardroom set in very good condition.

Perfect for tournaments (up to 16 players) or cash games.

Chip breakdown:

- 62 Yellow, 75 Red, 197 Blue, 196 Pink, 20 Gray

Extras: Paulson rack + birdcage case included.

Price: $2,500 USD (shipping not included). Ships from France.

Buyer pays any US customs/taxes.

Prefer to sell full set, but open to selling items individually if needed.

i can send new photo

SHIPPING TERMS:

Buyer pays shipping and any applicable customs/duties. Shipping quote provided upon request.

SHIPS VIA:

Colissimo International (France Post) or UPS / FedEx / DHL express, depending on buyer preference.

Classified Listing Rules:

This is a legitimate sale of a personal collectible. Buyer is responsible for all customs/duties/taxes. Payment must be received before shipping. Serious inquiries only.