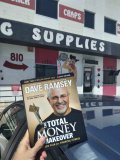

This book changed my life about ten years ago when I picked it up at the library. Since then I try to give this book out and spread the word whenever I can.

So I'd like to pass some more copies on to whoever would want a quick read...

Qualifications, is really anything, I don't care. But I think it would make the most impact if you...

1. Continually ask yourself "where the fuck did my money go?"

2. Have an open mind.

3. Have some motivation for a positive change.

I'll give out up to ten books, one a day for ten days starting Monday. Used, from eBay probably. I think I have to keep this in conus bc of shipping costs...

Not sure about the terms. Or if anyone will even want to take me up on this. If for some reason there is a lot of interest, I'll deal a hand of some sort, or random number.

*************EDIT********8 copies have been spoken for. Two remain. Claim interested in comments before 6pm Thursday. If there are more than 2 interested, I will do a PLO flip for the last two.

If you actually read this whole thing and are interested but haven't heard of Dave Ramsey, check him out on YouTube. You'll know after a couple minutes if you would be open to his book or not.

And while we are on the subject, any other recommendations or there?

Ultimately my goal is to get more money into PCF'ers pockets so you guys can keep buying my chips! Not really. That's like a distant second.

So I'd like to pass some more copies on to whoever would want a quick read...

Qualifications, is really anything, I don't care. But I think it would make the most impact if you...

1. Continually ask yourself "where the fuck did my money go?"

2. Have an open mind.

3. Have some motivation for a positive change.

I'll give out up to ten books, one a day for ten days starting Monday. Used, from eBay probably. I think I have to keep this in conus bc of shipping costs...

Not sure about the terms. Or if anyone will even want to take me up on this. If for some reason there is a lot of interest, I'll deal a hand of some sort, or random number.

*************EDIT********8 copies have been spoken for. Two remain. Claim interested in comments before 6pm Thursday. If there are more than 2 interested, I will do a PLO flip for the last two.

If you actually read this whole thing and are interested but haven't heard of Dave Ramsey, check him out on YouTube. You'll know after a couple minutes if you would be open to his book or not.

And while we are on the subject, any other recommendations or there?

Ultimately my goal is to get more money into PCF'ers pockets so you guys can keep buying my chips! Not really. That's like a distant second.

Last edited: